At the December 5 presentations of the economic impact and traffic studies relating to the proposed $7 million South 5th Street Bridge, Pagosa Springs Mayor Volger assured the crowd there would be more public input ahead of any decisions by the Town Council. He went on to say that during the next 90 days they would be researching answers to the questions and concerns raised by the study and by the public.

Having attended that presentation, I was a surprised to read in last week’s Pagosa Springs SUN that a decision on moving forward with building the 5th Street Bridge might appear on the Town Council agenda for its first 2017 meeting, set for Tuesday, January 3. If my math is correct, that “decision time” would be 33 days, a little short of the 90 days the Mayor promised publicly on December 5.

I had planned to take a considerable amount of time, after the New Year, to carefully review and analyze the traffic study made by LSC Transportation Consultants and the economic impact study prepared by Economic and Planning Systems (EPS) of Denver, as presented by managing principal Andrew Knutson. With the newly announced potential decision deadline moved up to the first Town Council Meeting of 2017, I thought it best to get to work and offer another perspective to the community and our elected officials.

I won’t spend time commenting on the traffic study, except to point out that based on my 22 years of local real estate development and marketing experience, I believe the traffic study was based on some very optimistic commercial and residential development scenarios.

Instead, I will focus on the EPS economic impact study. I want to compliment Andrew Knutson for the very professional presentation he made to the community on December 5. I know that given the local historical economic data, projecting the impact of the proposed 27-acre ‘Springs Village’ development — and constructing a positive case to justify a taxpayer-funded $7 million bridge — presented a monumental challenge.

Early on during his presentation, Mt. Knutsen indicated the Springs Partners’ development plan for the property was not the type of plan EPS would recommend. He was against including a large commercial and retail elements in the project, feeling most of the focus should be on residential homes plus a high quality, national brand hotel with a spa. I think many of us in the audience agreed that such an approach could make more sense, given the abundance of empty commercial space and undeveloped commercial pads available within the Town. Thus far, the new Wal Mart has not attracted a single other national retailer to the Aspen Village development within the Town of Pagosa Springs. There are more than 20 pads ready for new buildings in that commercial development alone.

Looking at the numbers displayed, which I challenged openly during the presentation, I again have to seriously question several of the basic assumptions EPS depended on to derive the financial projections they presented.

First, though our community does not presently have available accurate and timely occupancy figures for all our lodging businesses, average year-round room occupancy ranges from 49%-54% are more realistic. However, in the EPS study, Mr. Knutsen projected an occupancy rate of 78%. Amazing!

We must wonder how would the average hotel occupancy rate be increased by 24%-29% based merely on one new 100-room hotel being built on the 27-acres owned by the Springs Partners. How, exactly, would Pagosa attract that many more visitors?

Looking further, EPS projected an Average Daily Rate (ADT) for the new hotel at $266 per night. An Average Daily Rate of $266 would put us above Santa Fe, and Durango! (You can check Travelocity.com for room rates at the Santa Fe Hilton Historic Plaza, El Dorado Hotel and Spa and Hotel Santa Fe, The Hacienda and Spa). What additional amenities and attractions would be required to achieve the projections presented by EPS?

When I suggested to Mr. Knutsen during his presentation that the Average Occupancy Rate and Average Daily Room Rate figures were overly (and grossly) optimistic, he agreed the figures needed to be reviewed more carefully. So, where did EPS get these figures? From the Springs Partners? Should more time have been spent on explaining how EPS sees these optimistic targets being reached?

The Town Council is expected to make an informed decision on whether to move forward on building the proposed $7 million South 5th Street Bridge — and using taxpayer-funded financing to pay for it. (This ignores an analysis of all the other financial needs within our community.) How can the Town Council make good decisions when they are not provided with realistic and verifiable economic information, but instead are provided with economic studies based on very unrealistic assumptions? If the assumptions are suspect, does it not follow the resulting projections are highly suspect?

What happens to the projected economic impact when the Average Occupancy Level is reduced to 50% and the Average Daily Rate is reduced to $225 or $200? In my opinion, few if any national hotel chains would consider signing a licensing agreement for their brand in a community with these lower rates. Given the cost of construction, debt service, licensing fees, hotel operating expenses and marketing budgets, it is highly unlikely a community with an overall occupancy rate of less than 65% would be an attractive market for a new upper tier national hotel property.

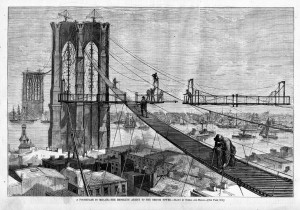

Perhaps my research is flawed, but I don’t think so. Perhaps Springs Partners already has a bona fide national hotel chain ready to build a hotel and spa the minute the Town Council commits to going in debt for $7 million. If you believe that, I have a bridge to sell you!

By the way, George C. Parker was a 20th century con artist who allegedly sold the Brooklyn Bridge to naïve investors… multiple times.

JANAURY 3, 2017 UPDATE: It looks as though the 5th Street Bridge Fiasco will get the THUMBS DOWN VOTE at tonight’s Town Council Meeting —Perhaps we can finally get on to more important Town matters!