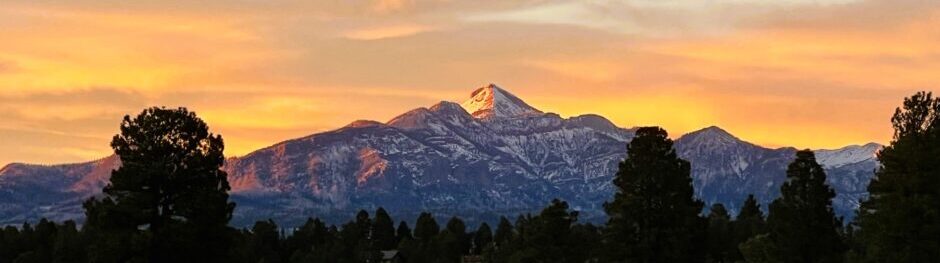

Square Top at Sunset by: Barbara Rosner

SQUARE TOP RANCH

The Square Top Ranch development plans were in fact unrealistic from the start. The level of density they proposed would have taken many decades to absorb, even if the real estate bubble had continued to expand. At one point they were proposing as many as 340 homes for the site, which in fact would have ruined the view corridors, drastically changed the wildlife habitat of the area and far exceeded the capacity of the existing road system in the Basin. Their projected selling prices had no relation to the local market or comparable sales within Southwest Colorado and their plan did not include any type of Market Feasibility Study. (In spite of, or, perhaps, because of this, they were able to secure over $15 million in equity investments.) The color renderings, site plans and marketing materials they created were impressive, especially to investors with limited market knowledge for Southwest Colorado.

The Archuleta County Planning Commission rejected their initial development plan and Mackey and Company went back to the drawing board, and back to the investors. By then they were already running low on funds and needed to recruit fresh equity partners. Interestingly, their marketing materials shown to their equity partner prospects still included financial projections based on the density levels that had already been turned down by the county.

As Mackey and Co. worked hard to reconfigure a development plan reducing the density down to 225 home sites, which the county might consider, the economy began to slow down. Their golf course developments in Pinehurst, North Carolina were floundering and their equity partners were starting to raise questions about expenses, unmet projections and an overall lack of progress with all of their projects. Loans against other projects they were involved in went into default as they were unable to raise more equity capital and unable to obtain additional loan extensions. Funding stopped and all work on Square Top came to a grinding halt.

For months equity partners in Square Top considered a number of different exit strategies. One of the larger equity partners proposed buying the others out and put forth an offer. There were many complications because of entanglements involving founding partner Walter J. “Rusty” Mackey Jr.’s bankruptcy filing. Finally a deal was struck and one of the partners completed the buyout in March of this year. The recorded price was $9,000,000. Financing was provided by Farm Credit in the amount of $4.85 million and $2.65 million was carried back by the exiting partners on a no-interest five year note. My guess is the Buyer probably did not have to put any more cash into the purchase other than his initial equity contribution.

Square Top Ranch had previously traded to the Mackey Group for $13,000,000 in 2006. In addition to the $4 million loss on the sale, I estimate another $1,000,000 or more was lost on related development expenses, consulting fees, legal expenses and holding costs. The new owner, Square Top Ranch, LLC lists Mathew Cook of Oak Park, IL, as Manager. Recently the ranch hosted the Outdoor Recreation Heritage Fund (ORHF) for a special October hunt for Wounded Veterans, what a generous use of a special property! Reportedly, it has no plans to develop Square Top Ranch, a relief no doubt to other property owners in the Upper Blanco Basin.