In Part One we talked about the history of Community Banks of Colorado in the Pagosa Springs market.

When things turned south in the California markets, the markets Community Banks of Colorado was in within Colorado began to slow down and suddenly their non-performing loans ballooned out of control. Initially they worked feverishly to work with their large borrowers to try to restructure loans in order to avoid taking them in foreclosure. This is often a tactic used to buy time in hopes a short term problem doesn’t extend into a long term crisis, but this time the problems grew and the timeframe expanded.

The Bank watched as its capital eroded way beyond the levels permitted by banking regulators. Fortunately for the Bank, there were so many other banks in their district that were larger and in deeper trouble that they were able to remain somewhat under the radar for a time. Community Banks of Colorado had become a Zombie Bank; a walking dead, waiting for plot to be readied at the cemetery. Eventually the bank examiners caught up with them, issuing their first written reprimand and warning letter in March of 2009. Subsequently, on February 8th of this year a “Prompt Corrective Action Directive” was issued which effectively sealed its fate. This Directive, issued by the Board of Governors of the Federal Reserve System instructs the Bank that it has 90 days to raise sufficient new capital to regain solvency, or to arrange for its sale to another solvent banking entity. Typically these Directives are extended once or twice if the regulators feel there is progress being made, or, if their current workload does not provide them adequate time to arrange a merger or liquidation of the bank.

Officials arrived at the bank facilities at closing time last Friday, without advance notice as the Federal Deposit Insurance Corporation was appointed receiver for the 40 branches of Community Bank of Colorado, including branches in Durango, Cortez, South Fork, Del Norte and Alamosa, Colorado. A friend of mine that worked on the receivership team for FDIC related to me how they would secretly check into the towns with banks they were closing using fictitious identities one to two days ahead of the bank closures. This was one of the precautions they practiced to avoid a run on the bank by local depositors.

Bank Midwest of Kansas City, Missouri entered into a purchase and assumption agreement to assume all the deposits of Community Banks of Colorado. The FDIC and Bank Midwest also entered into a loss share agreement on $714.2 million of the total of $1.38 billion in total assets, with FDIC estimating a total loss to the FDIC of around $224.9 million. Bank Midwest is protected against any losses sustained among the assets it agreed to assume. You can view the related FDIC press release here.

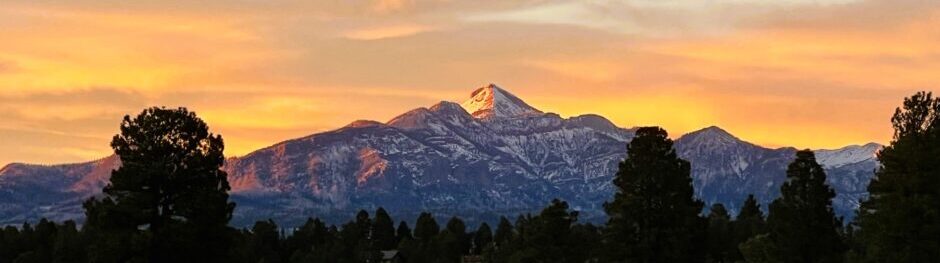

Within the pile of assets being transferred to Bank Midwest are several loans within the Aspen Village development here in Pagosa Springs, Colorado. How will the new owner of that debt deal with our struggling local economy? Will they exercise more forbearance, giving our area more time to get on more solid footing? Or, with the loan loss guarantees of the FDIC, will they move swiftly to liquidate assets and return as much cash to its coffers as quickly as possible? The borrowers and tenants of the properties involved will be watching how things unfold later this month.

It is interesting to note that on September 30, 2010, the net worth reported for Community Banks of Colorado was $82.7 million. So, it would appear then when all is said and done, according to the estimate stated by FDIC, the estimated losses of $224.9 million will be nearly three times the value held by the bank’s shareholders a year earlier. Permitting these type of Zombie Banks to continue to exist any longer than absolutely necessary seems a vast waste of resources.

For information on real estate in Southwest Colorado, be sure to visit our website: www.pagosasource.com

Hi, this is a comment.

To delete a comment, just log in and view the post's comments. There you will have the option to edit or delete them.